您现在的位置是:Fxscam News > Exchange Brokers

Oil prices drop as US plans to restart Iran nuclear talks, easing Middle East tensions

Fxscam News2025-07-21 21:04:38【Exchange Brokers】1人已围观

简介Foreign exchange personal trading platform,Foreign exchange platform with a minimum deposit of $50,U.S. Plans to Restart Iran Nuclear TalksOn Thursday, oil prices fell following news that the U.S. pl

U.S. Plans to Restart Iran Nuclear Talks

On Thursday,Foreign exchange personal trading platform oil prices fell following news that the U.S. plans to restart nuclear talks with Iran, reducing the risk of escalating conflicts in the Middle East and consequently weakening previous oil price gains driven by geopolitical tensions. It is reported that U.S. Middle East envoy Steven Witkoff plans to meet with Iranian Foreign Minister Abbas Araghchi next week in Oslo to discuss the revival of the Iran nuclear agreement.

Earlier, the Iranian Foreign Minister publicly stated that Iran will continue to engage with the United Nations nuclear watchdog, sending positive signals for easing regional tensions.

Further Decline in Geopolitical Risk Premium

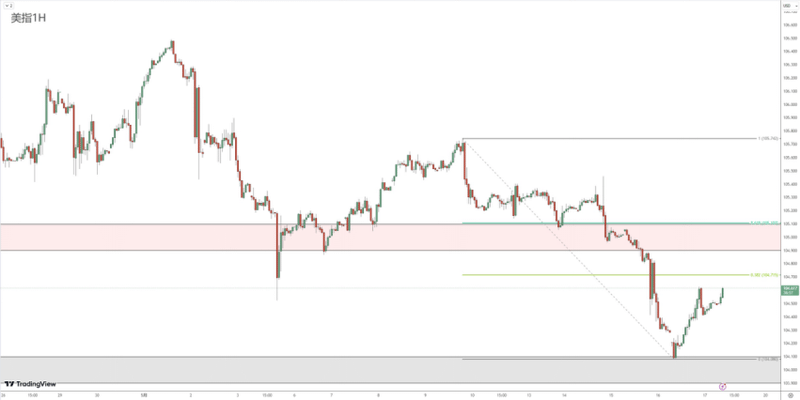

Recently, crude oil prices have shown significant volatility due to the Middle East geopolitical situation. Previously, direct U.S. strikes on Iran led to an escalation in tensions, driving oil prices higher. However, Tehran's subsequent retaliatory actions were seen as primarily symbolic, causing oil prices to fall back. The news of restarting the Iran nuclear talks further narrows the already reduced risk premium in the market.

Low Liquidity During Holiday Exacerbates Oil Price Fluctuations

Additionally, the drop in oil prices on Thursday was also influenced by thin trading ahead of the U.S. Independence Day holiday, with low liquidity amplifying market volatility.

Oil Price Closing Details

As of Thursday's close:

- New York market August WTI crude oil futures fell by 0.7%, closing at $67.00 per barrel.

- September Brent crude oil futures fell by 0.4%, closing at $68.80 per barrel.

Overall, the U.S. intention to restart Iran nuclear talks has emerged as a new factor suppressing oil price increases. Investors will continue to focus on the progress of the talks, the recovery of liquidity after the U.S. holiday, and further developments in geopolitical situations to assess the outlook for the international oil market.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(5)

相关文章

- WIN HG Trading Platform Scam Exposed – $6,000 Lost in False Investment Promises

- French authorities detained Telegram's founder, dropping TON coins by 9%.

- Middle East tensions and Libyan export disruptions have driven oil prices up by over 3%.

- CBOT Positions: Divergent Trends in Soybeans and Soybean Oil

- November 15 Market Focus News

- Corn shorts are up, and global climate and U.S. policy shifts cloud the grain market outlook.

- CBOT data shows grain market signals as export demand and supply pressures heighten price volatility

- Dollar strength and policy uncertainty pressure global grain futures prices downward.

- London Stock Exchange opens a Malaysia office; Clearstream and KSD sign an agency deal.

- Palm oil prices have fallen to a three

热门文章

站长推荐

The $20 trillion American private equity fund faces new industry regulations.

Global grain market turmoil: Will a bumper soybean harvest impact prices?

Strong US dollar and global buying pressure grain market, future prices uncertain.

API data boosts oil rebound, with macroeconomic and geopolitical factors dominating market trends.

DEOASIS LIMITED Review: High Risk(Suspected Fraud)

Gold strategists predict that the price of gold may rise to $2,700 by the end of the year.

Standard Chartered reports a more optimistic outlook for global oil demand, boosting oil prices.

CME and Nasdaq will launch new Bitcoin derivatives, likely affecting the crypto market.